The Quiet Power of IPEN: Securing Your Family’s Future

My grandfather, a man who could fix anything with duct tape and a prayer, had a blind spot: paperwork. He built our family cabin with his own two hands, a testament to his grit and love. But when it came to planning for the future, he preferred the comfort of “we’ll figure it out later.” That “later” arrived suddenly, and the scramble to untangle his affairs, while fueled by love, was also tinged with avoidable stress. It’s a story I’ve heard echoed countless times, a quiet reminder that securing your financial legacy isn’t just about money; it’s about peace of mind for you and the people you cherish most. It’s about IPEN.

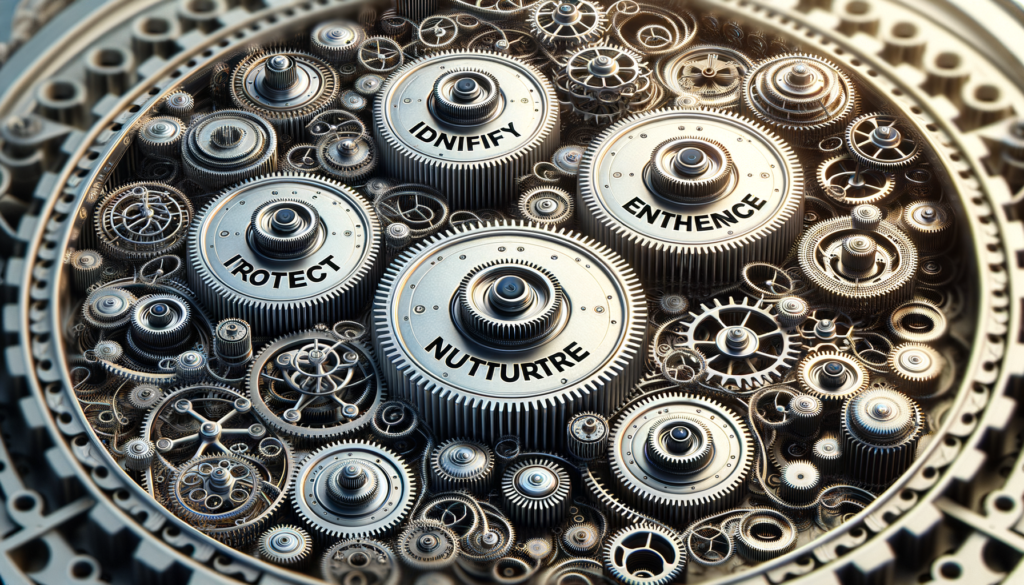

What is IPEN and Why Should You Care?

IPEN stands for Identify, Protect, Enhance, and Nurture – a holistic approach to financial well-being that goes beyond simply accumulating wealth. It’s about building a resilient financial fortress that can weather life’s storms and provide for your loved ones, even when you’re no longer around to steer the ship. Think of it as creating a financial ecosystem, not just a bank account. It’s about understanding that true financial security is a dynamic process, not a destination.

Identifying Your Assets: More Than Just Dollars and Cents

The first step, Identify, is like taking inventory of your financial kingdom. It’s more than just knowing your bank balance; it’s about understanding the full scope of your assets. This includes the obvious – bank accounts, investments, property – but also the often-overlooked: life insurance policies, intellectual property, even sentimental items with significant value. Imagine a treasure map: you can’t chart a course to buried gold if you don’t know where X marks the spot. Identifying your assets is about drawing your own financial map, a crucial first step in navigating your financial future.

Protecting What Matters: Shielding Your Legacy

Once you’ve identified your assets, the next step is Protection. This is where estate planning comes into play, and where many people’s eyes start to glaze over. But think of it this way: you wouldn’t build a beautiful home without a roof, would you? Estate planning is the roof over your financial house, protecting it from the elements of uncertainty. This includes creating a will, establishing trusts, and designating beneficiaries for your accounts. It’s about ensuring that your hard-earned wealth goes where you intend it to, not getting lost in the bureaucratic labyrinth.

The Will: More Than Just a Document, a Declaration of Intent

A will isn’t just a legal document; it’s a love letter to your family. It’s your voice echoing into the future, ensuring your wishes are respected. It’s about more than just distributing assets; it’s about providing clear instructions, minimizing potential conflicts, and offering your loved ones a roadmap through a difficult time. Imagine it as a final hug, a reassurance that you’ve taken care of them, even in your absence.

Enhancing Your Resources: Growing Your Financial Garden

Enhancing your resources is like tending a garden. You’ve planted the seeds (identified your assets), built a fence to protect them (estate planning), and now it’s time to nurture their growth. This stage of IPEN is about actively managing your finances to maximize their potential. It involves smart investing, minimizing debt, and exploring opportunities to grow your wealth over time. Think of it as compounding interest, not just on your money, but on your financial knowledge and wisdom.

Investing: Planting Seeds for Future Growth

Investing isn’t about getting rich quick; it’s about building a secure future, brick by brick. It’s about understanding your risk tolerance, diversifying your portfolio, and making informed decisions that align with your long-term goals. It’s about planting seeds today that will blossom into financial security tomorrow.

Nurturing Your Legacy: The Long View

Nurturing your legacy is the final, and perhaps most important, piece of the IPEN puzzle. It’s about recognizing that financial well-being isn’t just about numbers; it’s about values. It’s about the impact you have on the world and the legacy you leave behind. This involves teaching your children about financial responsibility, supporting causes you believe in, and making conscious choices that reflect your values. It’s about building a legacy that extends beyond your lifetime.

Beyond the Balance Sheet: Values-Based Financial Planning

Think about what truly matters to you. Is it providing educational opportunities for your children? Supporting a charity that’s close to your heart? Leaving the world a little better than you found it? Nurturing your legacy is about aligning your financial decisions with your deepest values, creating a ripple effect that extends far beyond your own lifetime. But how do you translate these values into concrete actions? How do you ensure your legacy reflects not just your wealth, but your heart?…

What Our Customers Say

See how people just like you are using Wills.com make their will online.

Wills.com: Supporting Your Estate and Financial Planning Goals

At Wills.com, we want to empower you with all of the tools and resources you need, to help you to not only manage your legal affairs but to also ensure your finances are sound, reliable, and fully reflective of all of your personal values and also your long-term financial and personal goals and objectives. We believe that everyone should be empowered to control all aspects of their planning, so we are also dedicated to making these valuable resources as accessible and user-friendly as possible.

Conclusion

The various political and economic changes currently unfolding offer an opportunity for those who are prepared to act strategically and take proactive steps to protect their assets. Wills.com is here to support your efforts toward long-term financial security and provides the tools you need to manage your estate plan with intention and confidence. With the right planning, you can move forward knowing you are building a future that is both stable and meaningful for generations to come.

Frequently Asked Questions

What is an IPEN?

IPEN stands for Inherited Property Exclusion. While not a universally recognized legal term, it generally refers to certain assets that may be excluded or treated differently during inheritance or estate administration. The specific rules regarding inherited property and exclusions vary significantly by jurisdiction and depend on factors like the type of asset, the will or trust in place, and applicable state laws.

How does an IPEN relate to estate planning?

Estate planning aims to manage the distribution of your assets after your death. Understanding how inherited property might be treated differently under your state’s laws is crucial for effective estate planning. For example, some states have laws that protect inherited property from creditors in certain situations. Proper estate planning can help ensure your wishes are respected regarding both inherited and personally acquired assets.

What is the difference between inherited property and other assets in estate planning?

Inherited property, as the name suggests, is received from someone who has passed away, either through a will, trust, or intestacy laws. Other assets are those you acquire during your lifetime. While both types of assets are generally part of your estate, inherited property may have special considerations regarding taxes, creditor protection, or distribution, depending on the specific laws of your jurisdiction.

Is inherited property always protected from creditors?

No, the protection of inherited property from creditors varies widely depending on state law and the specific circumstances. Some states offer certain protections for inherited assets, especially if they are held in a specific type of trust. It’s essential to consult with an estate planning attorney in your state to understand the applicable rules.

What are some common misconceptions about IPENs?

One common misconception is that all inherited property is automatically exempt from estate taxes or creditor claims. This is not universally true. Another misconception is that the term “IPEN” has a standardized legal definition across all jurisdictions, which is also incorrect. It’s crucial to rely on legal advice specific to your situation rather than generalizations.

How can I ensure my inherited property is distributed according to my wishes?

A well-drafted will or trust is the best way to ensure your inherited property, along with your other assets, is distributed according to your wishes. Clearly specifying your intentions in your estate plan can help prevent disputes and ensure a smooth transfer of assets to your beneficiaries.

How does a will handle inherited property?

A will outlines how you want all your assets, including inherited property, to be distributed after your death. Without a will, state intestacy laws will determine the distribution, which may not align with your wishes. It’s important to clearly identify inherited assets in your will to avoid confusion.

Can a trust help manage inherited property?

Yes, trusts can be particularly useful for managing inherited property. Certain types of trusts can offer creditor protection and control how and when beneficiaries receive inherited assets. A trust can also help minimize estate taxes and probate costs in some cases.

Should I include a digital asset clause in my will regarding inherited digital property?

Including a digital asset clause in your will is becoming increasingly important. This clause specifies how you want your digital assets, including any inherited digital property like online accounts or cryptocurrency, to be handled after your death. This helps ensure your executor has the authority to manage these assets.

How much does it cost to include inherited property in my estate plan?

The cost of including inherited property in your estate plan depends on the complexity of your situation and the attorney’s fees. Generally, updating a will or creating a trust to include specific provisions for inherited assets will involve legal fees. Consult with an estate planning attorney for a personalized quote.

How long does it take to update my estate plan to include inherited property?

The time required to update your estate plan can vary depending on the complexity of the changes and the responsiveness of your legal counsel. Simple updates can often be completed within a few weeks, while more complex estate plans involving trusts might take longer.

Should I use Will.com or consult with a lawyer for handling inherited property in my estate plan?

Wills.com provides valuable tools and resources for creating essential estate planning documents. However, for complex situations involving inherited property, especially if significant value or creditor protection is involved, consulting with a qualified estate planning attorney is highly recommended. They can provide personalized advice tailored to your specific circumstances and state laws.